Smith Names Connie Chung Vice President of Accounting, APAC

Connie will lead the company’s financial administration in the Asia-Pacific region and ensure adh...

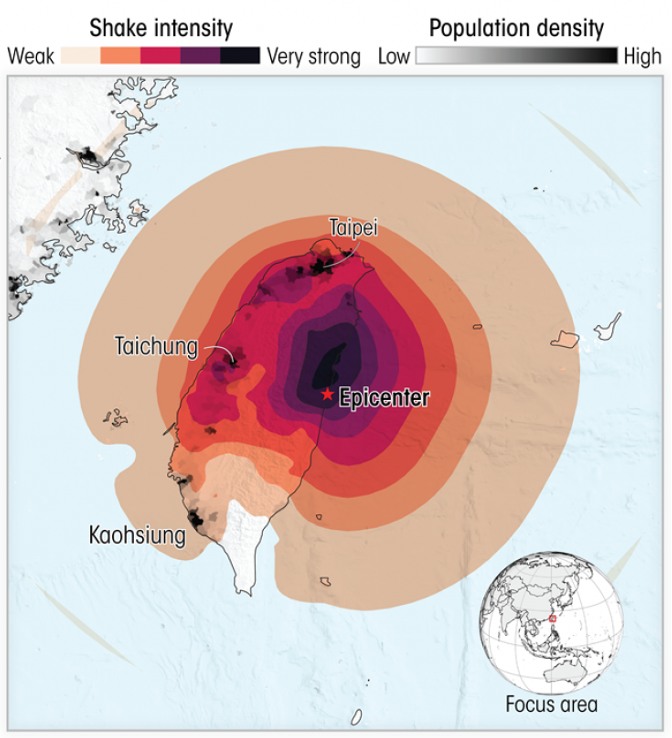

A 7.4-magnitude earthquake occurred off the eastern coast of Taiwan within Hualien County at 7:58 AM local time on Wednesday, April 3. It is the largest earthquake to hit Taiwan since 1999. There are reports of casualties, and searches continue for individuals trapped or missing since the earthquake.

For the electronics industry, earthquakes are significantly concerning. Facilities in Taiwan have a hand in producing more than 60 percent of the world’s semiconductors—including more than 90 percent of the most advanced semiconductors—and their production capacities range from wafer manufacturing to chip end-packaging.

The earthquake epicenter was on the eastern coast of the island, just north of the middle. Most semiconductor facilities follow the population centers along the western coast, from Taipei in the northwest to Kaohsiung in the southwest.

Image Source: DownToEarth

Image Source: Contact TAIWAN

Power was lost in areas across the entire island, including at some semiconductor manufacturing facilities. Many facilities also stopped production and evacuated employees as a precaution and to allow them to assess possible damage. Currently, little verified news is coming from manufacturers in Taiwan other than that they are all assessing their facilities. TSMC is the major concern, especially considering the NVIDIA GPU shortage, and there are many rumors that are circling about the company. One report stated that the facility that makes the wafers for NVIDIA did not shut down and appears undamaged. TSMC also said that 70 percent of its semiconductor making equipment had recovered within 10 hours of the quake and that production at its most advanced factory, which temporarily shut down, was already at 80 percent of its pre-earthquake rate.

TrendForce has noted:

Micron shut down its Taiwanese facilities to evaluate damages. The company also stopped quoting any products, although it is currently in the midst of negotiating second-quarter prices with end customers. In turn, both SK hynix and Samsung have also stalled quoting customers while updates continue to filter out from the area.

“TrendForce concludes that while there may be a slight short-term increase in DRAM spot prices, the continuation of this trend is uncertain due to persistent weak demand.” (Source: Trendforce)

More significant news is still to come.

Historically, Taiwan has experienced frequent earthquakes, and semiconductor manufacturers have gone to great lengths to reinforce buildings and create precautions to mitigate damages to equipment and products. With that in mind, SiliconExpert did an evaluation on recent earthquakes using its machine-learning algorithm, “which aggregates data from a wide range of events, including historical trends, to predict possible outcomes” and compiled data about products affected—no matter the location of the epicenter—which is outlined in the table below:

Due to the epicenter location, there does not seem to be any evidence at this time suggesting that the impacts of this earthquake will reach the averages provided by the SiliconExpert report referenced above.

Over the past six years, several significant earthquakes have been centered around Hualien and have had varying degree of influence on the supply chain, as outlined in the Smith-generated data below:

February 7, 2018: 6.4 magnitude (additional details below)

April 18, 2019: 6.7 magnitude (additional details below)

October 23, 2019: 6.0 magnitude (no apparent effects)

March 23, 2022: 6.7 magnitude (additional details below)

January 24, 2024: 5.2 magnitude (no apparent effects)

FEBRUARY 7, 2018 EARTHQUAKE IMPACTS

Passives were mostly tied to the already underway MLCC shortage, which was caused by under-expansion of chipmakers and their unpreparedness to account for the market’s rapidly growing demand. It was quickly stopped by a multitude of expansions and increased production rates from the MLCC makers. While the earthquake may have worsened the problem, it was not the root, or even a significant, cause.

APRIL 18, 2019 EARTHQUAKE IMPACTS

Requests for quotes began to decrease while revenue, generated from automotive-electrification demand, began to increase. No apparent supply issues resulted from the quake.

MARCH 23, 2022 EARTHQUAKE IMPACTS

Requests for quotes peaked in November 2021 and were on the decline until January 5, 2022, in line with the annual cycle. In February 2022, requests for quotes began to increase and peaked again around March 7, 2022, before the Hualien earthquake. Afterward, they stagnated and then fell.

The earthquake does not appear to have caused any acute shortages or supply problems. The cyclical nature of the industry and continued backlogs from COVID were the foundational issues that led to heightened requests for quotes.

CONCLUSION

While this is the worst earthquake of the five noted, history would suggest that there could be some increases in spot shortages, but likely not any long-term issues. The electronics industry is still in an excess status, and production rates are extremely low at all chip and passive manufacturers for non-automotive parts. Most problems will likely be from wafer loss due to power outages and shutdowns and not long-term closures. This could be anywhere from days to two months of loss. We should expect to see some more problems come from the automotive industry on MLCCs and MOSFETs and likely some passive spot shortages in other segments due to those losses.

However, since we are in the initial stages of assessments from Taiwanese companies, expect something unexpected to be reported soon. Something will come of this incident to change supply chains somewhere.

We will continue to monitor the situation and share the latest updates as they become available.

Click here to view our sources.

Smith Names Connie Chung Vice President of Accounting, APAC

Connie will lead the company’s financial administration in the Asia-Pacific region and ensure adh...

Smith Achieves Global ISO/IEC 27001:2022 Certification

The company’s commitment to information security has been confirmed

Smith Will Exhibit at the RLA EMEA Summit in Amsterdam, Table #150

The company will showcase its tailored supply chain solutions designed to support sustainable rev...

您可通过以下三种方式,轻松关注Smith微信公众号: